Auto Dealer Solutions

Privacy and Safeguards Solutions for Auto Dealers

KPA Privacy and Safeguards provides dealers a guided solution that ensures your dealership has proper safeguards in place to keep consumers’ personal information safe and secure.

10 Steps for Navigating FTC Safeguards Compliance

FTC Safeguards coverage is guided by industry-leading experts who provide a 10-step proven path for complete compliance. This robust set of tools includes a combination of consulting, training, and regulatory content. Hover over each step to learn more.

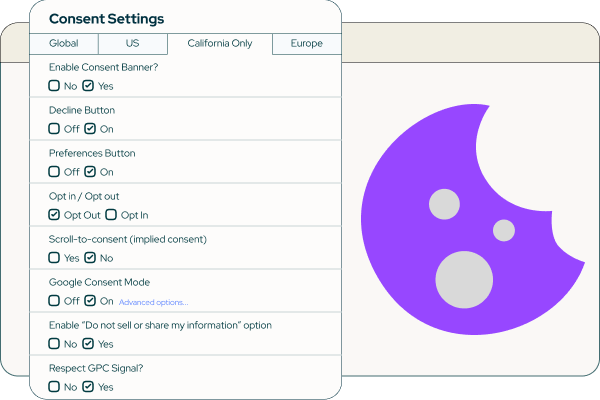

Privacy Consent banners

State-specific privacy consent banners for website compliance

KPA offers a consent banner solution that ensures your website is compliant with state-specific privacy laws, like GDPR and the CCPA. Because our platform adapts to the location of visitors, it doesn’t compromise your website’s broader marketing efforts.

- Adaptive Consent Banner Technology

The consent banners dynamically adjust to the visitor’s location, ensuring compliance with state-specific laws while preserving the integrity of your analytics data. - Configurable for your Sales and Marketing Efforts

Tailor your website’s privacy banners to meet regional laws and customer expectations, all without affecting your marketing and sales performance. - Comprehensive Litigation Protection

By securing the proper consents, KPA’s consent banners protect your dealership from potential legal issues and fines associated with data recording practices.

Assessment and Documentation

Time-intensive, but critical to demonstrate compliance.

Assessing risk and documenting processes are two time-intensive but critical facets to demonstrating safeguards compliance. But you don’t have to start the process from scratch.

Lean on KPA to walk your dealership through assessing the state of your privacy and safeguards program. Fine-tune your written programs, policies, and response plans based on our comprehensive library of best practices.

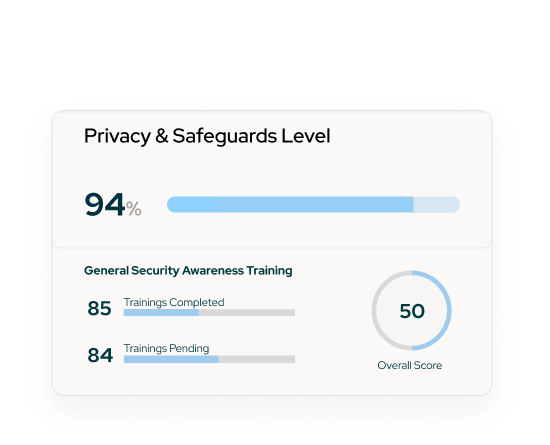

Training

Educate your workforce on information security best practices.

Complete workforce training solution designed to train and reinforce information security best practices.

Expert-developed training

Highly targeted online training courses yield strong employee participation and awareness across your dealership – from your deal desk to your shop floor.

Cover your critical risk areas

Topics include privacy, information security, disposal, phishing, PCI, and more.

Monitoring & Testing

Ongoing monitoring and penetration testing ensures you practice what you preach.

KPA can help you demonstrate your dealership is continuously monitoring the systems and processes you have put in place.

- Certification and assessments

- Penetration testing

- Vulnerability testing

Reporting

Thorough annual reporting demonstrates complete compliance.

The FTC requires your Qualified Individual report out on overall compliance and material matters.

Let KPA help with the heavy lifting – we can help you prepare reporting on:

- Risks assessed, managed, and controlled

- Service provider arrangements

- Testing results

- Security violations, events, and responses

- Proposed changes to the information security program

Complete Dealership Compliance

Let KPA show you how our all-in-one Solution guides compliance throughout your dealership.

Essential Safety References

Empower your safety initiatives with our curated collection of resources designed to foster workplace safety, compliance, and risk management.

Customer Spotlight

Learn how KPA customers are saving time and money, while building a safer workforce.

KPA has proven to be extremely knowledgeable of the ever-changing regulations to which we as a franchised automobile dealership have to adhere.

President, Arlington Toyota