5 Actions That Build Trust and Transparency in the Car Buying Experience

If you haven’t already, check out the results from the KPA Dealership Trust Survey. They take a hard look at look at the perception and reality of dealership advertising, sales, and financing. It’s a fascinating look into into human psychology – and how it impacts your dealership’s bottom line.

The survey uncovered that dealers are receiving an unfounded poor reputation. While there is a perception issue among car buyers, the opposite is the actual reality. A minority of car buyers surveyed ever experienced a negative experience or hidden fee.

While most people don’t experience deceptive sales practices when buying or leasing a vehicle, people naturally focus on negative comments. And these negative comments eat into a dealer’s bottom line. So, how can dealers bridge this gap between perception and reality?

KPA’s here to help dealers overcome this perception issue, which can only improve their business. A strong focus on compliance efforts is one of dealers’ best steps to reassure buyers.

FTC CARS Resource Hub

The upcoming CARS Rule, effective July 30, 2024, will greatly influence dealership practices. Access our comprehensive resource hub for all the necessary information.

5 Steps to Demonstrate Compliance and Build Consumer Trust

By building a solid culture of trust and transparency, dealers can bridge the gap between perception and reality. We’ve got five best practices for you to focus on:

Our Better Workforce Blog is your Ultimate Guide!

Stay informed with weekly industry updates, expert insights, best practices, and actionable tips to enhance workplace safety and compliance.

What’s the common theme among these recommendations? A focus on being proactive.

Taking proactive steps means measuring, monitoring, and improving the buying process – finding issues before they can tarnish your hard-earned reputation. Following these steps demonstrates at every point in the purchase process that you are a trustworthy dealership committed to providing the best customer experience.

“Buying or leasing a vehicle is a major financial decision for many Americans,” said KPA’s CEO, Chris Fanning “KPA partners with dealerships to help them operate in compliance with current regulations while also building trust with their customers and earning their dollars.”

KPA’s Here to Help You Demonstrate Your Commitment to a Great Buying Experience

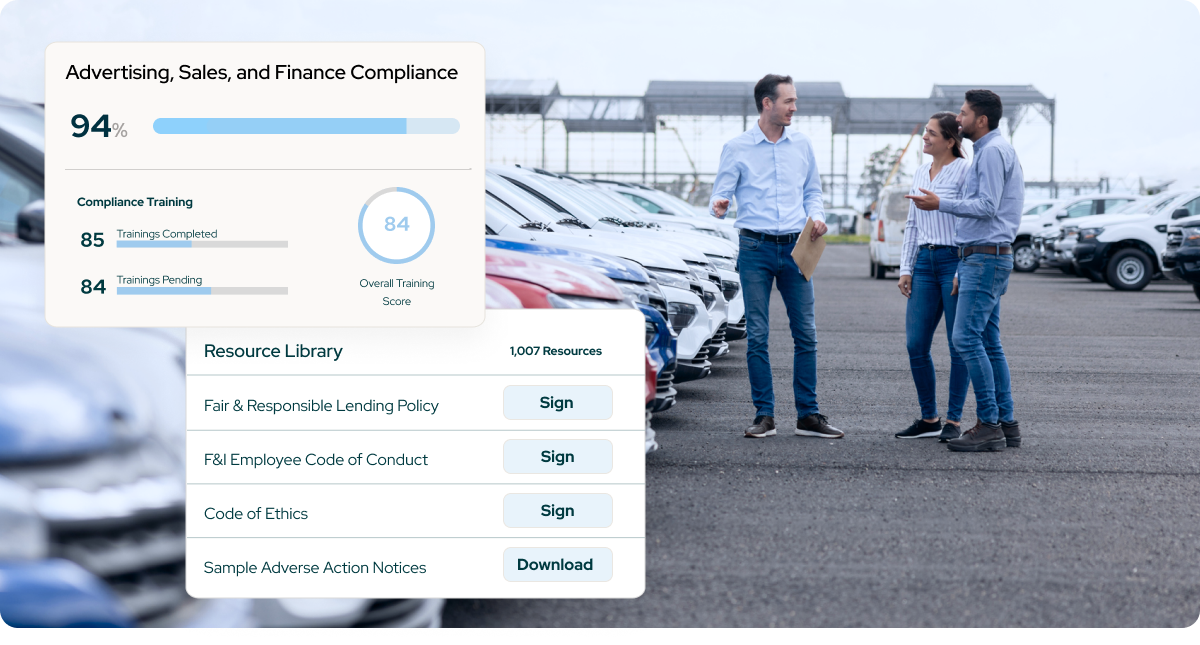

Improperly advertising, selling, and financing vehicles is an enormous risk to your business and reputation. KPA provides complete compliance solutions for Advertising, Sales, and Finance compliance as a whole as well as to support CARS Rule Compliance in particular.

Learn more about Advertising, Sales and Finance Solutions from KPA >>