The question keeping many dealership owners up at night isn’t whether a data breach will occur—it’s when. And more importantly, whether they’ll be ready.

Recent DMS provider breaches have sent shockwaves through the automotive industry, temporarily shutting down systems for dealerships across the country. Even providers with robust security measures weren’t immune. If it can happen to them, what makes you think your dealership is protected?

The uncomfortable reality is this: Your customers’ sensitive financial and personal information is as valuable as the vehicles on your lot—and just as vulnerable to theft.

The Threat Is Real, and It’s Industry-Wide

Data breaches have become alarmingly common across all industries, and automotive dealerships are prime targets. We’ve already seen many dealers switch DMS providers after highly publicized breaches damaged trust and disrupted operations. These weren’t small incidents—they were significant events that exposed vulnerabilities even in systems considered secure.

The threat landscape for dealers includes:

- Increasingly sophisticated cyberattacks targeting customer financial data

- Ransomware that can shut down your entire operation

- Phishing schemes aimed at your staff

- Third-party vulnerabilities in your technology stack

- Insider threats, whether malicious or accidental

Your dealership holds a treasure trove of information: Social Security numbers, credit reports, driver’s license details, loan applications, insurance information, and payment card data. Cybercriminals know this, and they’re actively targeting businesses just like yours.

Protect Your Dealership: Privacy Practices That Drive Profits & Prevent Penalties

Recent actions by federal and state agencies underscore a new and growing legal and financial risk associated with inadequate privacy practices. Help your dealership build trust and avoid regulatory pitfalls.

The FTC Safeguards Rule: Compliance Isn’t Optional

Here’s what many dealers don’t realize: You’re already legally required to have cybersecurity protections in place. The FTC Safeguards Rule isn’t a suggestion—it’s the law.

Specifically, Step 9 of the Safeguards Rule requires that your safeguards team has clear guidance on:

- Detection: How you’ll identify when a breach occurs

- Response: What immediate actions you’ll take

- Recovery: How you’ll restore systems and operations

- Remediation: How you’ll fix vulnerabilities

- Revision: How you’ll update your protocols based on lessons learned

Without a proper Incident Response Plan, you’re not just exposed to cyber threats—you’re also violating federal compliance requirements. This exposes your dealership to:

- State and federal penalties for failing to meet notification requirements

- Mandatory public disclosure of the breach

- Legal action from affected customers

- Regulatory fines and sanctions

The law is clear: When customer data is compromised, everyone at your dealership needs to know their role immediately. Confusion costs time, and time compounds damage.

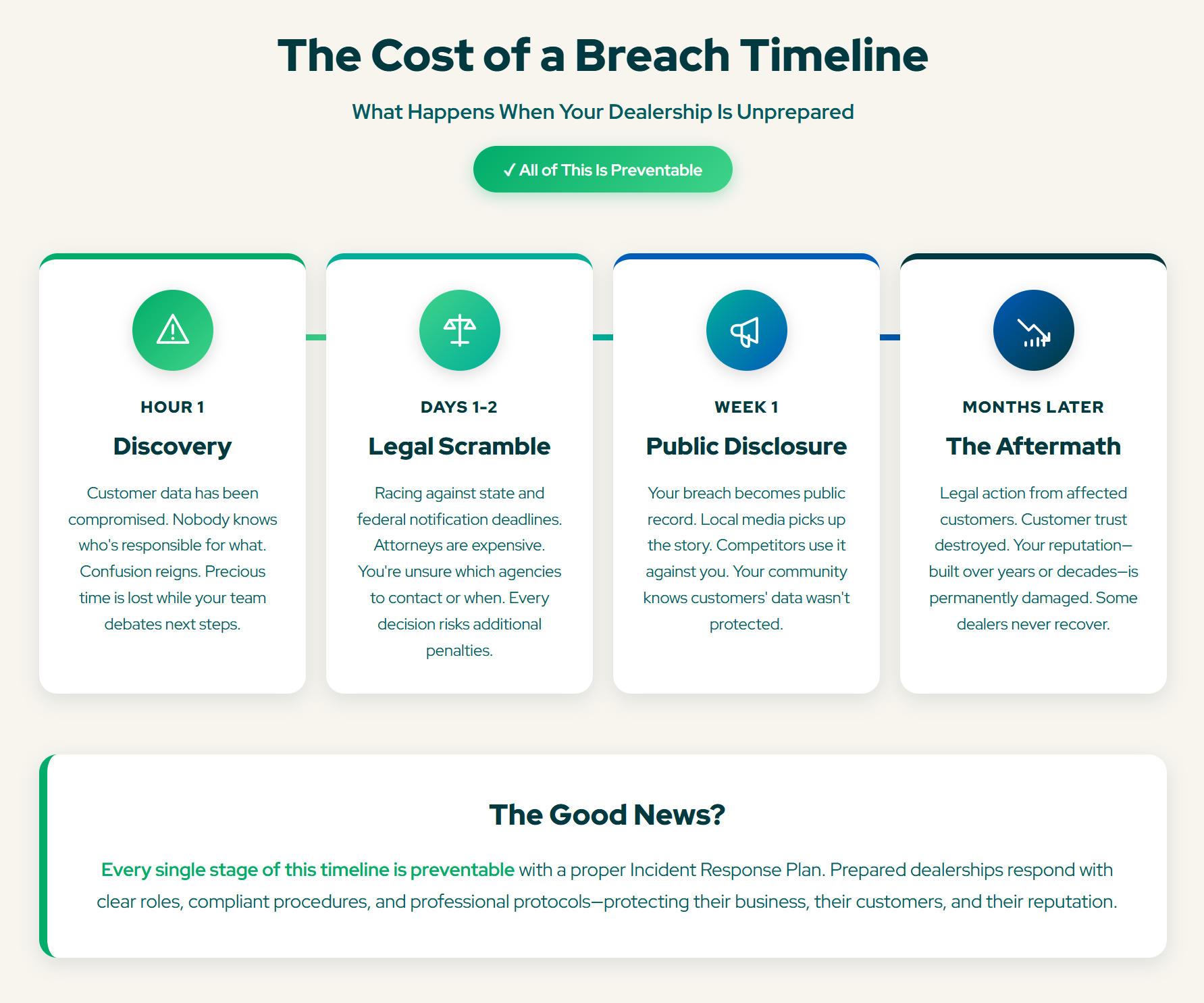

The True Cost of Being Unprepared: A Timeline

Let’s walk through what actually happens when a breach occurs and you don’t have a plan in place. This isn’t hypothetical—this is the reality dealerships face every day.

Hour 1: Discovery

Your IT person notices something wrong. Customer data has been compromised. Panic sets in. Nobody knows who’s responsible for what. Should you call your attorney? Contact customers? Notify the authorities? Who makes these decisions? While your team debates, precious time slips away, and the breach continues.

Days 1-2: Legal Scramble

You’re now racing against state and federal notification deadlines you weren’t even aware existed. Attorneys are expensive, and every consultation reveals another requirement you didn’t know about. You’re not sure which agencies to contact, when to contact them, or what information they need. Every decision could expose you to additional penalties.

Week 1: Public Disclosure

Your breach becomes public record. Local media picks up the story. Competitors whisper about it to your mutual customers. Your community—the same community where you’ve built your reputation over years or even decades—now knows your customers’ data wasn’t protected. The headlines aren’t kind.

Months Later: The Aftermath

Legal action from affected customers begins. Your insurance rates skyrocket. Customer trust is destroyed. Some customers who’ve been loyal for years quietly take their business elsewhere. Your sales team notices prospects mentioning the breach. Your reputation in the community—built over years or decades—is permanently damaged.

Some dealers never recover.

And here’s the worst part: All of this is preventable.

What Your Customers Expect (and Deserve)

Put yourself in your customer’s shoes for a moment. When they walk into your dealership, they’re not just buying a car—they’re trusting you with some of their most sensitive personal information. They expect that information to be protected with the same care you’d protect your own.

Your customers know that data breaches happen. They read about them in the news. But they also expect that professional businesses—businesses they choose to work with—have taken reasonable steps to protect their data and respond appropriately if something goes wrong.

When you fail to protect their information, or worse, when you fail to respond properly after it’s been compromised, they won’t give you a second chance. They’ll simply go somewhere else. And they’ll tell others to do the same.

Just as dealers switched providers after major DMS breaches, your customers will switch dealerships after yours.

The Stark Difference Preparation Makes

The contrast between prepared and unprepared dealerships couldn’t be clearer:

Without an Incident Response Plan:

- Confusion and delays when a breach occurs

- Missed notification deadlines leading to penalties

- Regulatory penalties and fines

- Public embarrassment and negative media coverage

- Lost customer trust that may never be recovered

- Significant legal exposure

- Potential business closure

With Proper Cybersecurity Planning:

- Clear roles and immediate action when incidents occur

- Compliant notification procedures that meet all deadlines

- Regulatory requirements satisfied

- Professional response protocols that minimize damage

- Customer confidence maintained through transparent communication

- Business continuity protected

- Reduced legal liability

The difference isn’t just operational—it’s existential. It’s the difference between a manageable incident and a business-ending catastrophe.

What Dealers Need to Do Right Now

If you’re reading this and feeling concerned, good. That concern should drive action. Here’s what you need to do:

1. Develop a Comprehensive Incident Response Plan

This isn’t a document that sits in a drawer. It’s a living, tested protocol that your entire team understands. It should outline exactly who does what when a breach is discovered, including specific names, roles, and contact information.

2. Ensure Your Safeguards Team Knows Their Roles

Your team can’t respond effectively if they don’t know what they’re responsible for. Regular training and drills aren’t just good practice—they’re what separates dealerships that survive breaches from those that don’t.

3. Establish Clear Communication Protocols

Who contacts customers? What do they say? When do you notify law enforcement? Which regulatory agencies need to be informed? These decisions can’t be made in the chaos of a breach—they need to be predetermined.

4. Implement Documentation Tools

Regulatory compliance requires documentation. You need systems in place to track what happened, when it happened, who was notified, and what actions were taken. Without this documentation, you’re exposed even if you did everything right.

5. Work with Experts Who Understand Your Industry

Automotive dealerships face unique compliance requirements and operational challenges. Working with cybersecurity experts who understand the automotive industry—who know about DMS systems, dealer operations, and industry-specific regulations—makes all the difference.

The Bottom Line

Cybersecurity Awareness Month may come and go, but the threats to your dealership don’t end when the calendar flips. Your regulatory obligations don’t disappear. Your vulnerability doesn’t decrease.

Right now, dealerships across the country are working to ensure they’re prepared for the inevitable. Their safeguards teams know exactly what to do when an incident occurs. Their customers’ data is protected by more than hope—it’s protected by planning, protocols, and preparation.

The data is clear: Breaches are becoming more common, more sophisticated, and more costly. The question isn’t whether your dealership will face a cybersecurity incident—it’s whether you’ll be ready when it happens.

In data security, proper preparation doesn’t just prevent penalties. It preserves your dealership’s future.

How KPA Helps Dealers with Privacy and Safeguards Compliance

KPA’s Privacy and Safeguards Solution provides dealerships with the tools and expertise needed to navigate the complex landscape of privacy regulations. With KPA, dealers don’t have to face these challenges alone.

Our comprehensive solution helps you:

- Develop and implement customized information security programs tailored specifically to auto dealerships

- Provide role-based training and security testing to strengthen your team’s awareness

- Meet technical requirements through vulnerability scanning, penetration testing, and security monitoring

- Create and manage documentation including risk assessments, incident response plans, and required reports

As a trusted partner with deep expertise in automotive compliance, KPA combines easy-to-use software, comprehensive training, and expert consulting to help dealers reduce incidents, avoid violations, and lower business risks. Our team guides you through each step of the compliance process, ensuring you have the right safeguards in place to protect both your customers and your business.

Don’t wait until your breach makes headlines. The time to act is now.

The question isn’t whether you can afford to invest in cybersecurity and incident response planning. It’s whether you can afford not to. What happens next is your choice.

Related Content

Explore more comprehensive articles, specialized guides, and insightful interviews selected, offering fresh insights, data-driven analysis, and expert perspectives.