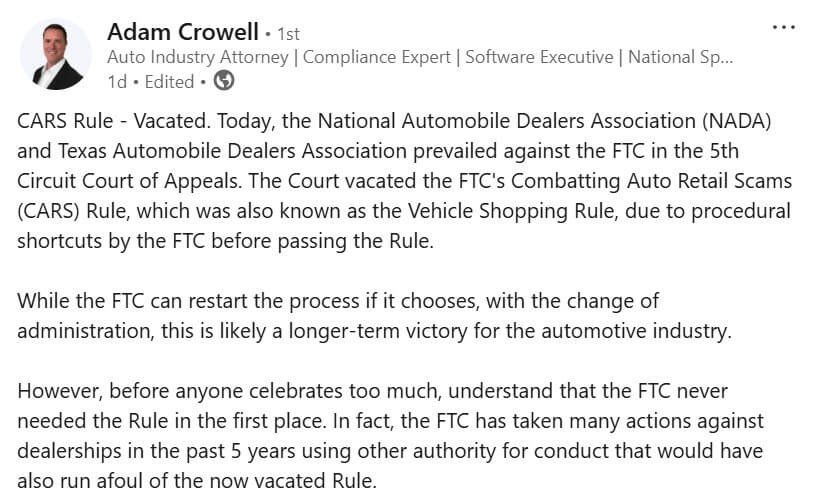

On January 27, the Fifth Circuit Court of Appeals voted 2-1 in favor of striking down the Federal Trade Commission’s (FTC) Combatting Auto Retail Scams (CARS) Rule, better known as the Vehicle Shopping Rule, because of shortcuts taken by the Commission FTC before passing the Rule.

Although this may be a short-term victory for the automotive industry, dealerships need to be aware that the FTC can and continues to target dealerships for many of the same purported deceptive practices the CARS Rule aimed to prevent, only using other avenues of authority. Not only will the FTC continue to use those other avenues, but dealerships are likely to see more action from states’ attorneys general going forward.

Previous Rules Remain to Protect Consumers

While you can breathe a little easier now that the CARS Rule has been vacated, dealers must remember that there is still a long list of unfair, deceptive, or abusive acts or practices (UDAP) that could attract the attention of the FTC and state attorneys general alike. Among those risky practices are misstating things like:

- Price or terms of purchasing, financing, or leasing a vehicle

- The availability or inclusion of any rebates or discounts when advertising price

- Whether financing approval is contingent on purchasing add-on products

- Availability of vehicles at an advertised price

- If the consumer has won a prize or sweepstakes

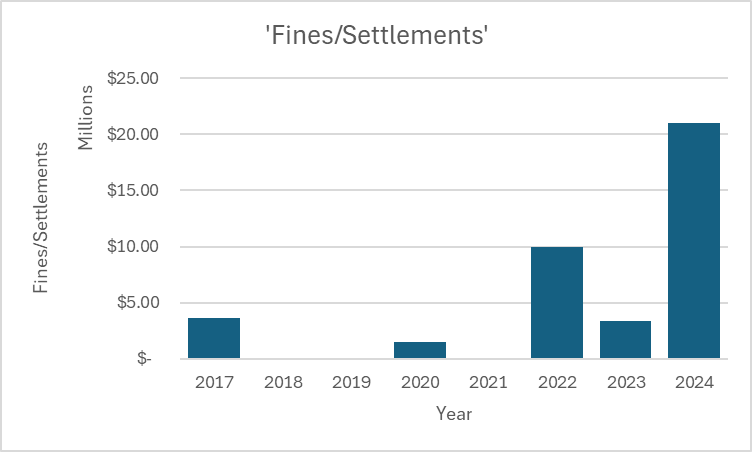

The FTC Has Not Needed the CARS Rule to Assess Fines

Many of the requirements in CARS were already in effect and had been enforced. Keep in mind that vacating CARS did not repeal anything.

A Brief Background

On January 4, 2024, the Federal Trade Commission published the final CARS Rule to take effect on July 30, 2024. The National Automobile Dealers Association and the Texas Automobile Dealers Association sued the FTC, which voluntarily stayed the Rule’s effective date. In October, the Fifth Court of Appeals heard oral arguments regarding the Rule’s legality.

The Rule would have profoundly impacted dealership advertising, sales, and financing strategies with disclosure requirements, prohibited misrepresentations, severe penalties, and new recordkeeping requirements.

Heads Up: The repeal of the CARS Rule doesn’t stop the FTC or State Attorney Generals from taking action against dealers, often for huge sums. In fact, they’re working together to root out unfair and abusive acts and practices.

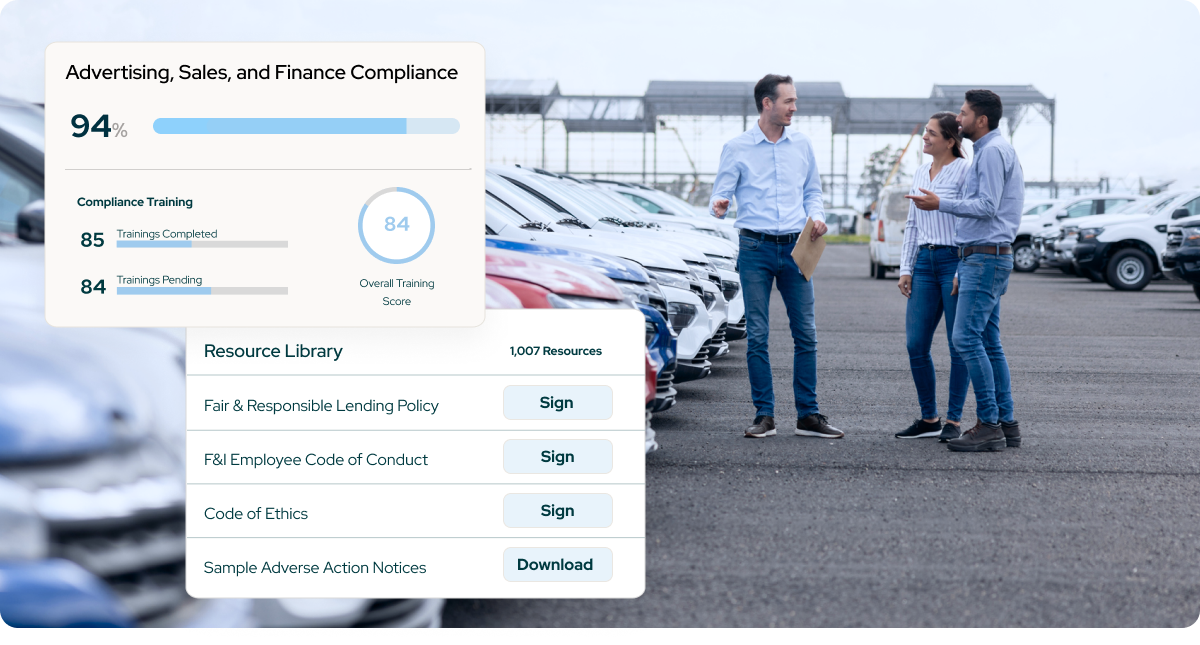

Stay out of regulators’ crosshairs with help from KPA

KPA’s here to help dealerships prevent consumer complaints, investigations, and enforcement actions. We offer advertising, sales, and finance solutions that guide dealerships to find and resolve issues proactively.

Related Content

Explore more comprehensive articles, specialized guides, and insightful interviews selected, offering fresh insights, data-driven analysis, and expert perspectives.