What You Need to Know About the New FTC CARS Rule

On December 12, the Federal Trade Commission announced a final rule for Combating Auto Retail Scams (CARS). The CARS Rule will have a profound impact on dealership advertising, sales, and financing strategies prior to its effective date of July 30, 2024. We’ve been following the FTC CARS Rule very closely since it was first proposed, and have put together what you need to know.

Is the FTC CARS Rule Any Relation to the Proposed Vehicle Shopping Rule?

Yes. First proposed in mid-2022, the CARS Rule was initially called the Motor Vehicle Dealer Trade Regulation Rule, and was often referred to within the industry as the “Vehicle Shopping Rule.” After reviewing solicited feedback from thousands of consumers, consumer advocate groups, dealerships, automotive trade associations, and industry experts, the FTC revised the proposed rule and re-named it.

What are the Penalties for Violating the CARS Rule?

Violations of the CARS Rule constitute unfair and deceptive acts and practices under Section 5 of the FTC ACT, and the FTC can impose penalties of $50,120 per violation.

Does the CARS Rule Apply in Every State?

Yes. The CARS Rule sets forth minimum standards across the country. If a state law or regulation gives even greater protection to consumers than the CARS Rule, the state standard will take precedence over the CARS Rule to the extent that there is a conflict.

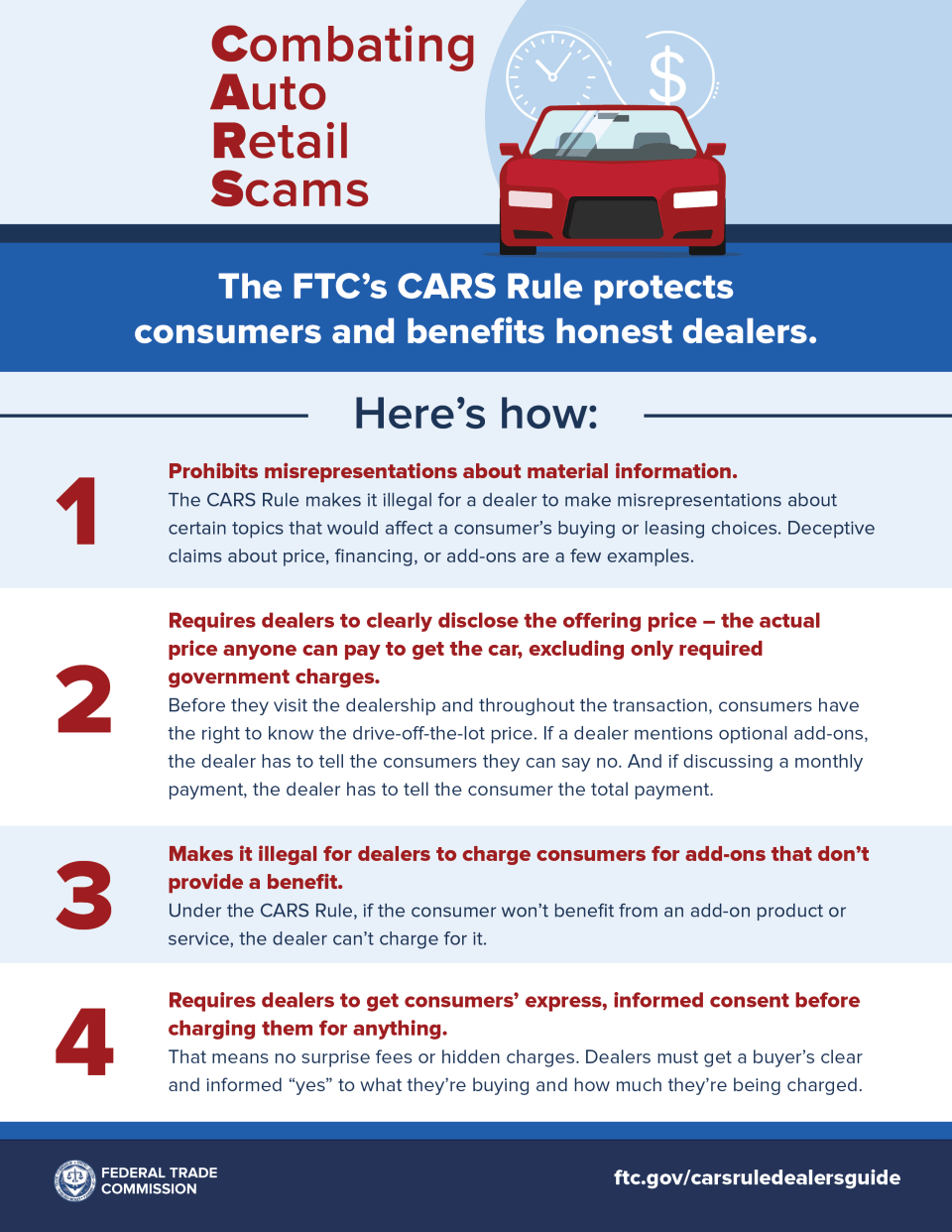

Source: FTC

What Does the CARS Rule Require and Prohibit?

Here’s a quick overview, but we’ll take a deep dive into each of these over the coming weeks.

There are additional disclosure requirements for payment quotes and payment comparisons, in addition to those already required by Regulation M and Regulation Z.

There are recordkeeping requirements. While some of these records must be kept longer, the CARS Rule specifically requires that certain records be kept for at least 24 months.

The CARS Rule requirements cannot be waived, and merely asking a consumer to waive any provision is a violation.

Subscribe to the KPA Blog to get deep dives on this topic sent right to your inbox.

Subscribe to the Blog:

Get Best Practices in Your Inbox

Get tips, tools, and articles sent to your inbox weekly.

Does KPA have an CARS Rule Solution?

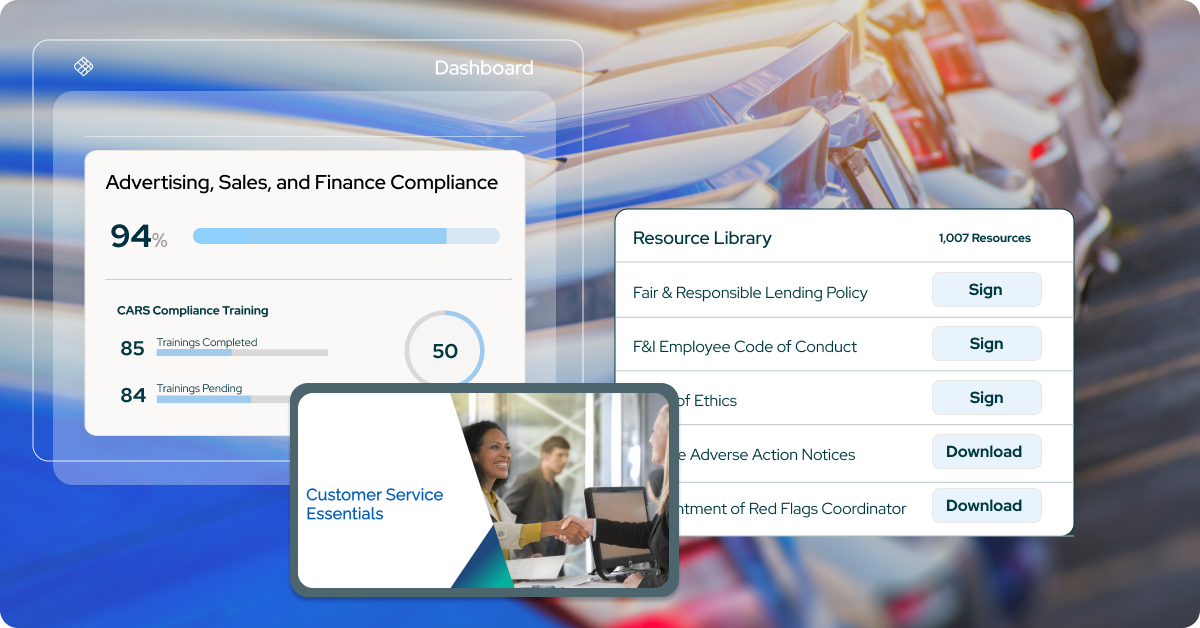

Yes, KPA has been working on its CARS Rule Solution ever since the proposed rule was first announced, and is the ONLY solution offering:

- Professional and automated website scans to help find and remediate violations of CARS, TILA, Reg M, Reg Z, and more, before vehicle delivery

- Remote and onsite deal jacket auditing

- Employee CARS Rule training, along with other advertising, sales, and F&I trainings

- Employee Assessments

- CARS Policies

- Consumer Complaint Management System

- Electronic archive for sales and marketing materials

We’ve been providing advertising, sales, and F&I solutions for over a decade, and KPA’s CARS Solution will help you navigate and comply with CARS well before July 30, 2024.

FTC CARS Resource Hub

The upcoming CARS Rule, effective July 30, 2024, will greatly influence dealership practices. Access our comprehensive resource hub for all the necessary information.