As we continue our journey through the 10 Steps to Advertising Sales and Finance Compliance, we arrive at a critical juncture: Consumer Complaint Management. This step is not just about addressing customer grievances; it’s about safeguarding your dealership’s reputation and preemptively mitigating regulatory risks.

The Importance of Consumer Complaints

Did you know that over 60,000 auto-related complaints are reportedly logged annually by agencies such as the Federal Trade Commission (FTC), the Consumer Financial Protection Bureau (CFPB), various state attorneys general, and other consumer protection groups? Even more striking is that over 50% of all investigations in the automotive space stem from these consumer complaints.

The message is clear: if you can effectively manage and reduce consumer complaints, you significantly lower the chances of regulators knocking on your door.

Proactive Complaint Management

The goal for dealers should be to encourage consumers to voice their concerns directly to the dealership first, allowing for swift resolution before they escalate to regulatory bodies. However, many dealerships currently employ a fragmented approach to handling complaints. Issues raised to service advisors or salespeople may not reach the right person, often due to fear of repercussions or lack of proper channels.

Implementing an Effective Complaint Management System

Dealerships should establish a straightforward system for customers to submit complaints, ensuring they are directed to the appropriate person for resolution.

Here are some key strategies:

The F&I Forbidden 20

While companies place a substantial focus on EHS management (and with good reason), crossing the line in F&I can do substantial damage to your dealership's reputation, plus fines starting at $10,000, and the potential for criminal charges.

The Benefits of Effective Complaint Management

By implementing a comprehensive consumer complaint management system, you can:

- Resolve issues quickly and directly with consumers

- Reduce the likelihood of regulatory investigations

- Identify and address the root causes of systemic issues within your dealership

- Improve customer satisfaction and loyalty

- Protect and enhance your dealership’s reputation

Remember, every complaint is an opportunity to improve your service and strengthen customer relationships. By viewing complaints as valuable feedback rather than nuisances, you can transform potential negatives into positives for your business.

Next Steps: Evaluate Your Current Process

Evaluating your current complaint management process is crucial. Ask yourself:

- Do we have a centralized system for handling complaints effectively?

- Is it easy for customers to voice their concerns?

- Are we analyzing complaint data to improve our processes?

If you answered ‘no’ to any of these questions, it’s time to consider implementing a robust consumer complaint management system. This will help protect your dealership from regulatory scrutiny and demonstrate your commitment to customer satisfaction and continuous improvement.

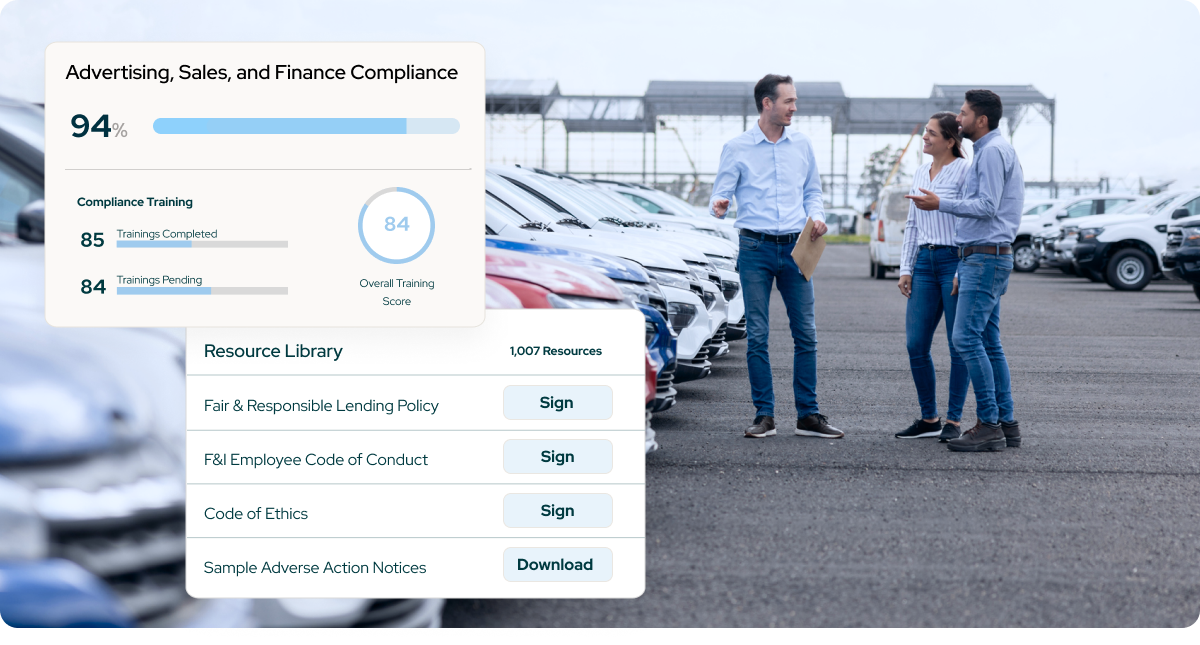

KPA helps dealers limit liability from the first contact to deal close.

With our complete compliance system and a team of advertising, sales, and finance compliance experts to guide you, protect your dealership, save money, and recapture countless hours of wasted time.

This structured approach ensures that dealerships are compliant and continually improve their compliance practices, leading to safer, more trustworthy operations.

Next week let’s look at dealer Inventory and Lot Management.

Stay up to speed on the 10 steps to complete advertising sales and finance compliance. If you haven’t already, subscribe to our blog for weekly installments of the 10 steps to complete compliance.

Related Content

Explore more comprehensive articles, specialized guides, and insightful interviews selected, offering fresh insights, data-driven analysis, and expert perspectives.