As we reach the final step in our 10 Steps to Advertising Sales and Finance Compliance for Dealers series, we focus on a critical element that ties all your compliance efforts together: Regulatory Reporting. This step is not just about meeting requirements; it’s about creating a culture of continuous improvement and accountability within your dealership’s advertising, sales, and finance operations.

The Power of Regular Reviews

The cornerstone of effective regulatory reporting is establishing a dedicated team that meets regularly – ideally quarterly, if not monthly. These meetings serve as a forum to:

- Review key performance indicators (KPIs) established by the team

- Assess progress on implementing advertising, sales, and finance policies and procedures

- Evaluate the effectiveness of employee training programs on compliance matters

- Analyze the results of various assessments (website, lot walks, deal jacket audits)

- Discuss industry trends and best practices in automotive advertising and finance

- Address and resolve customer complaints related to advertising claims and finance practices

KPI Dashboard: Your Compliance Compass

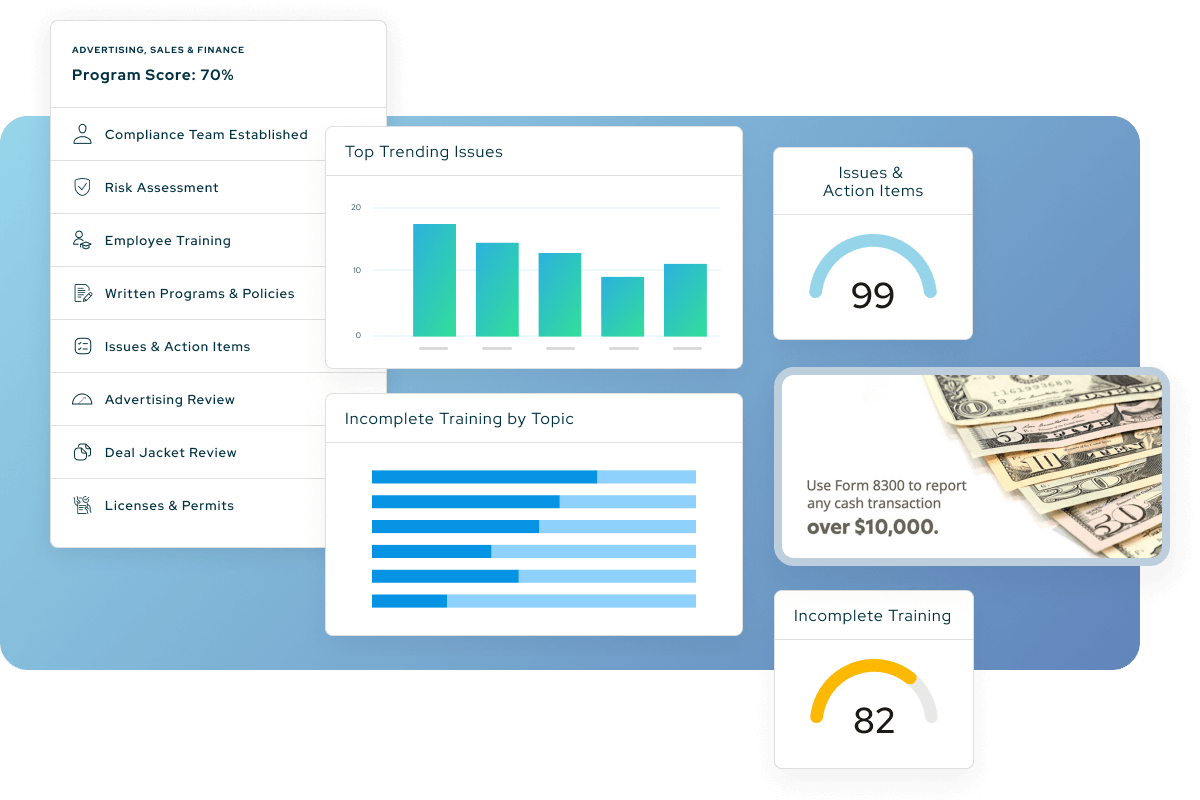

Implementing a KPI dashboard is crucial for tracking your dealership’s compliance health in advertising, sales, and finance. This dashboard should monitor:

- Team establishment and engagement in compliance activities

- Implementation of plans, programs, and policies specific to advertising and finance

- Training completion rates on relevant compliance topics

- Performance on audits and assessments of advertising materials and finance practices

- Issue identification and resolution in sales and finance processes

- Consumer complaint management related to advertising claims and finance terms

By visualizing these metrics, you can quickly identify areas of excellence and those needing improvement in your advertising, sales, and finance compliance efforts.

Is Your Advertising in Compliance with FTC Regulations? Find out with this Dealership Advertising Cheat Sheet.

The Annual Report: Your Compliance Story

The culmination of your year-round efforts is the annual report. This document serves multiple purposes:

Compliance in Motion: Your Journey Continues

As we conclude our “10 Steps to Advertising Sales and Finance Compliance for Dealers” series, remember that compliance is not a destination but a journey. The strategies we’ve discussed throughout this series are your roadmap to navigating the complex landscape of dealership compliance in advertising, sales, and finance.

By embracing these principles and making them an integral part of your dealership’s operations, you’re not just avoiding potential pitfalls; you’re positioning your business for long-term success and building trust with both customers and regulators.

Keep your team engaged, your compliance efforts robust, and your commitment to ethical advertising, sales, and finance practices unwavering. Here’s to your continued success in mastering the art and science of dealership compliance!

KPA helps dealers limit liability from the first contact to deal close.

With our complete compliance system and team of advertising, sales, and finance compliance experts to guide you, minimize your risk, save money, and recapture countless hours of wasted time.

This structured approach ensures that dealerships are not only compliant but also continually improving their compliance practices, leading to safer, more trustworthy operations.

Related Content

Explore more comprehensive articles, specialized guides, and insightful interviews selected, offering fresh insights, data-driven analysis, and expert perspectives.