If you’re an organization that processes credit applications, it is your duty to provide an Adverse Action Notice if a consumer is denied credit. And you’ve got to provide it within 30 days of receiving a credit application. There are two key laws here (both federal) that govern the requirements around adverse action notices — the Equal Credit Opportunity Act (ECOA) and the Fair Credit Reporting Act (FCRA). They’re in place to make sure consumers applying for credit are given the reasons a creditor took adverse action on the application (or on an existing credit account).

Adverse action means:

- Denying credit to an applicant

- Refusing to grant credit in substantially the amount or on substantially the terms requested by the applicant, unless the applicant accepts your counteroffer;

- Any action taken or determination that is adverse to the interests of the consumer (for example, unwinding a spot delivery)

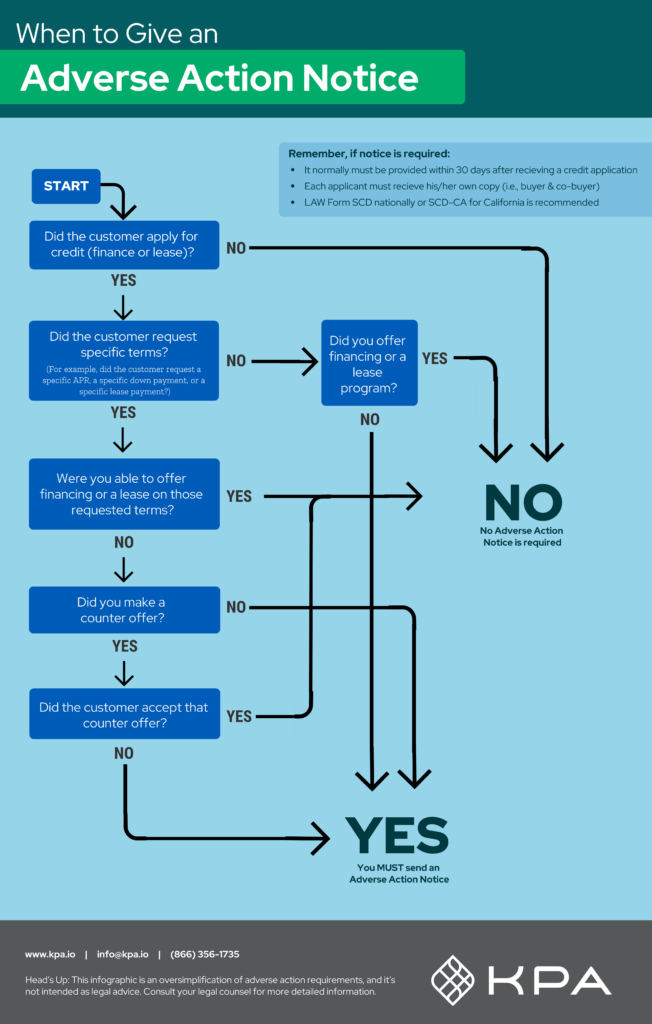

So, when should you provide an Adverse Action Notification?

This handy flow chart can help you figure it out…

F&I Software & Services Designed for Dealerships

Vera F&I software and services are specifically designed for vehicle dealers including automotive, truck, RV, marine, and power sports. Our F&I compliance solutions will help you develop compliant sales processes, train sales and finance teams, safeguard consumer information, and maintain clean deal jackets—all to help you minimize risk and maximize profits.