FTC CARS Rule Resource Hub

On December 12, 2023, the Federal Trade Commission announced a final rule for the CARS Rule (in some circles known as the Vehicle Shopping Rule). This rule will have a profound impact on dealership advertising, sales, and financing strategies. We’ve been following the rule closely since it was first proposed and have developed this resource hub with everything you need to know.

FTC CARS Rule Hearing

Oral arguments between the Federal Trade Commission (FTC) and dealerships over the legality of the Vehicle Shopping Rule (aka the CARS Rule) culminate during a hearing on Wednesday, October 9th at 4:00 CT. Listen live or follow along with the post-hearing recordings.

Live Legal Analysis

Tune in here or on LinkedIn for real-time insights on the oral arguments, delivered by KPA’s legal expert, Adam Crowell. His live commentary offers a unique opportunity to understand the proceedings as they unfold.

ON-DEMAND WEBINAR

Vehicle Shopping Rule on Trial: KPA Post-Argument Analysis

Join KPA for a comprehensive analysis of the oral arguments in the case challenging the Vehicle Shopping Rule. Our legal experts will delve into the key arguments presented by both sides, the potential outcomes, and the implications for the automotive industry and consumer protection.

Webinar

Basics of the FTC’s New CARS Rule

In this on-demand webinar, KPA’s VP of Corporate Development and an automotive compliance attorney, Adam Crowell, will dig into the CARS Rule details you need to know and the changes you need to make.

According to the FTC, “The primary purpose of the FTC’s CARS Rule is to add truth and transparency to the car buying and leasing process by making it clear that certain deceptive or unfair practices are illegal – for example, bait-and-switch tactics, hidden charges, and other conduct that harms consumers and honest dealers.”

Get all the details on the new rules impacting dealer’s advertising, sales, and financing strategies. Learn about penalties for violating the rule, disclosure requirements, and prohibited misrepresentations.

Frequently Asked Questions

The Federal Trade Commission’s Combatting Auto Retail Scams Rule (or CARS Rule for short) has been a hot topic for dealers since it was announced in December of 2023. The rule will have a profound impact on dealer advertising, sales, and financing strategies. The rule is designed to protect consumers from deceptive practices when buying or leasing a vehicle.

The Federal Trade Commission’s Combatting Auto Retail Scams Rule (or CARS Rule for short) has been a hot topic for dealers since it was announced in December of 2023. The rule will have a profound impact on dealer advertising, sales, and financing strategies. The rule is designed to protect consumers from deceptive practices when buying or leasing a vehicle.

First proposed in mid-2022, the CARS Rule was initially called the Motor Vehicle Dealer Trade Regulation Rule, and was often referred to within the industry as the “Vehicle Shopping Rule.” After reviewing solicited feedback from thousands of consumers, consumer advocate groups, dealerships, automotive trade associations, and industry experts, the FTC revised the proposed rule and re-named it.

Violations of the rule constitute unfair and deceptive acts and practices under Section 5 of the FTC ACT, and the FTC can impose penalties of $50,120 per violation.

It’s unclear right now. As part of the rulemaking process, the FTC is holding a hearing on October 9th, where we will get more clarity on the effective date. Watch this on-demand webinar to learn more.

The rule applies to “any self-propelled vehicle designed for transporting persons or property on a public street, highway or road.”

Right now, this includes auto dealers and excludes things like boats, motorcycles, RVs, and golf carts. Beyond car dealers, there’s a gray area around medium—or heavy-duty trucks, tractors, or trailers.

There are various rules impacting the advertising of vehicles for sale. A few of them include:

- The rule prohibits automobile dealers from listing vehicles that are unavailable for sale.

- The rules also warn against making untrue or misleading “pre-approval” claims.

- Things like “speed reading” disclosures in radio and TV ads and placing disclaimer language behind “view details” links on your website have also been forbidden.

Dealers must clearly disclose the offering price: The full cash price that a dealer will sell or finance the vehicle to a consumer, less any mandatory government fees (such as tax, title, and registration fees). Dealers cannot include deductions in the advertised price for rebates or down payments in the Offering Price.

To eliminate any perception of deceptive practices, when displaying a payment, the rule requires dealers to display the total amount after making all payments and the total payment amount due at signing or downpayment.

Car buyers must also be able to compare two payments with varying amounts and see a clear disclosure that the customer will pay more over the life of the loan for the lower payment.

According to the FTC, “A dealer may not charge for an add-on product or service if the consumer wouldn’t benefit from it.”

An add-on product cannot be presented to a customer unless it is disclosed that it is not required for purchasing or leasing the vehicle, and cannot be sold without the express, informed consent of the customer. The rule prohibits dealers from the predatory practice of charging for items that provide little to no benefit to the consumer. This prevents dealers from charging for things like adding nitrogen to tires.

Learn more about what’s considered an Add-On in this article >

While some records must be kept longer, the FTC rules specifically requires that certain records be kept for at least 24 months.

In an interesting interplay between federal and state laws, the rule aims to set minimum standards across the country. The rule was set if a state law or regulation gives even greater protection to consumers than the CARS Rule, the state standard will take precedence to the extent of conflict.

The Latest Articles on the FTC CARS Rule

Mastering Consumer Complaint Management for Dealers: Regulators are Watching

Discover how effective consumer complaint management can shield your auto dealership from regulatory risks and boost customer satisfaction. Learn key strategies for implementing a robust system to handle and leverage customer feedback.

Bulletproof Your Dealership: The Power of Advertising & Deal Jacket Reviews

Learn how advertising and deal jacket audits can ensure auto dealership compliance, avoid fines, and maintain trust.

How Does Your Car Buying Process Affect Your Dealership’s Reputation?

Explore how the car buying process impacts dealership reputation and learn best practices for attracting and retaining customers.

5 Actions That Build Trust and Transparency in the Car Buying Experience

Improve your dealership’s reputation and bottom line by building trust and transparency with buyers with these 5 actionable steps from KPA.

KPA Dealership Trust Survey: Understanding the Gap Between Perception and Reality

Discover the results of the KPA Dealership Trust Survey and understand the gap between perception and reality in the car buying experience.

KPA Car Dealership Trust Survey: While A Minority of Americans Experience Deceptive Selling At Dealerships, Most Still Distrust Them

WESTMINSTER, Colo., February 22, 2024 – KPA, a leading provider of compliance solutions for over 15,000 U.S. automotive dealerships, today…

CARS Rule Pause Doesn’t Shield Dealers from FTC and State AG’s Actions: Here’s an Example

The FTC and State AGs can still take action against dealers for unfair practices despite the pause of the CARS Rule. Here’s an example.

Understanding Informed Consent: A Guide to Navigating the FTC’s CARS Rule Compliance

Need help navigating the FTC’s CARS Rule? Learn the do’s and don’ts of providing Informed Consent. KPA’s here to help you navigate FTC compliance with ease.

The Latest FTC CARS Rule Developments, and How They Impact Your Dealership

Discover the latest developments in the FTC CARS Rule and how it affects your dealership. Learn about the potential scenarios and steps to take.

Navigating the FTC CARS Rule: All About Add-Ons

Learn how to navigate the FTC CARS Rule and comply with add-on requirements. KPA’s compliance solutions help dealers avoid penalties and stay on the right side of the law.

Drive Toward CARS Rule Compliance by Steering Clear of Deceptive Claims

Protect your dealership from legal troubles by avoiding deceptive claims under the FTC’s CARS Rule. Stay compliant and out of trouble. Learn more now.

Price Transparency: Here’s What You Need to Know for CARS Rule Compliance

Learn about Price Transparency – and how the Offering Price impacts your dealership’s compliance with the FTC’s CARS Rule. Stay compliant with KPA’s help.

Follow a 10-Step Journey to CARS Rule Compliance.

Have questions? Looking for more detailed compliance guidance? KPA is here to help.

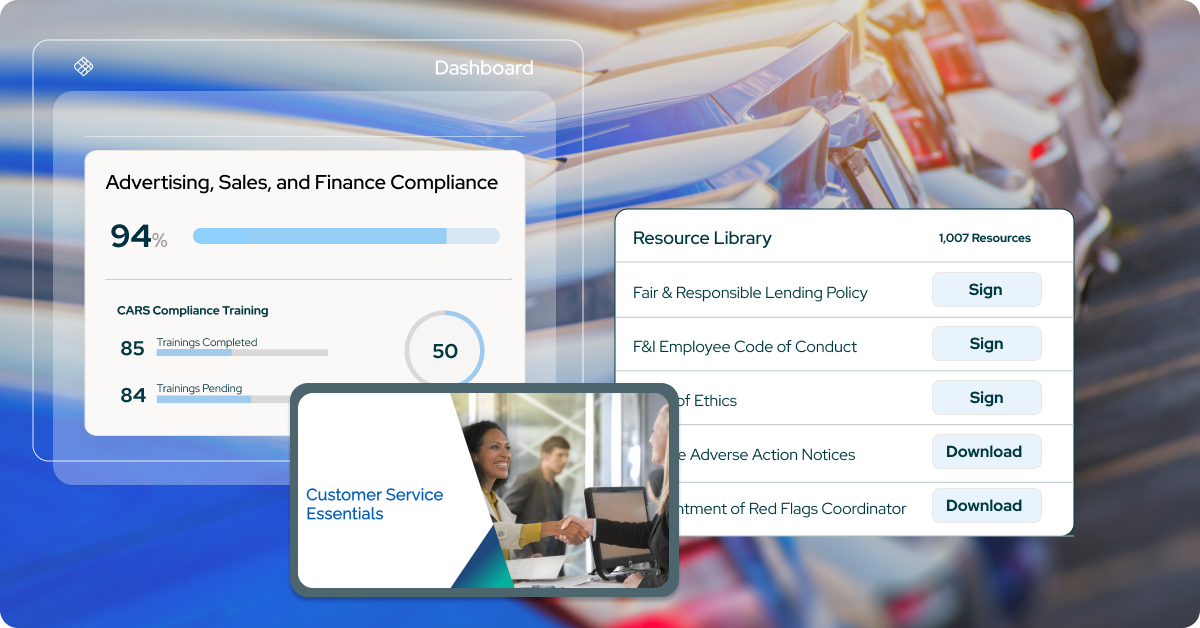

Navigate the challenges posed by the Vehicle Shopping Rule seamlessly with comprehensive coverage. KPA has your back. We’ve been doing this work for decades and have a complete compliance solution for you. KPA’s unique combination of software, training, and consulting services can provide the resources your people and your organization need.