If you haven’t heard, the FTC has paused the CARS Rule. Let’s review what has happened so far, the scenarios that can play out, and the steps dealers should take going forward.

The FTC’s newly announced Combatting Auto Retail Scams Rule (or CARS Rule for short) has been a hot topic for dealers since it was announced in December. The CARS Rule will have a profound impact on dealership advertising, sales, and financing strategies prior to its effective date of July 30, 2024.

Quick disclaimer:

Please do not consider this as legal advice. If you have specific legal questions, reach out to your attorney so they can answer them.

What led to this pause?

On January 4th, the FTC published the CARS Rule into the federal register.

This is a typical part of their process. And, typically, it takes two or three weeks for it to be recorded in the federal register.

The day after the rule was published to the federal register, NADA and the Texas Auto Dealers Association filed a petition for review in the Fifth Circuit Court.

They challenged the CARS Rule for a few reasons:

- They had concerns about the wording of the regulation itself, along with questions about the definitions of certain terms.

- They noted that the FTC did not follow the process called an Advanced Notice of Proposed Rulemaking (AMPR). NADA and the Texas ADA argue that the CARS Rule itself is improper.

- They requested that the court expedite the matter for hearing and asked that the matter be stayed or that the regulation itself be stayed until the court can resolve the issue.

10 days later, the FTC announced that they were pausing the enforcement date for the CARS Rule.

The FTC voluntarily decided to pause enforcement for the litigation to happen to eliminate any miscommunication to dealers.

According to the FTC, “Petitioners’ arguments for a stay rest on mischaracterizations of what the Rule requires of covered motor vehicle dealers, including inaccurate claims that it will require dealers to overhaul their practices and substantially increase compliance costs. In fact, the Rule does not impose substantial costs, if any, on dealers that presently comply with the law, and to the extent there are costs, those are outweighed by the benefits to consumers, to law-abiding dealers, and to fair competition—as honest dealers will not be at a competitive disadvantage relative to dishonest dealers.

Nonetheless, Petitioners’ assertions and suggestions that legally compliant dealers have to make unnecessary changes to satisfy Petitioners’ misunderstandings of the Rule have created uncertainty.

Additionally, Petitioners are seeking expedited consideration of the PFR, and if that request is granted, a stay of the effective date pending expedited review should not postpone implementation of the Rule by more than a few months, if at all. Balancing the equities here, the Commission has determined that it is in the interests of justice to stay the effective date of the Rule to allow for judicial review.

A Federal Register notice to reflect this action is forthcoming. Once the PFR’s merits are resolved, the Commission will publish a new document in the Federal Register establishing a new effective date.”

What does this mean for your dealership?

There are a few scenarios that could play out from here.

Most of the CARS Rule is already the standard in the industry.

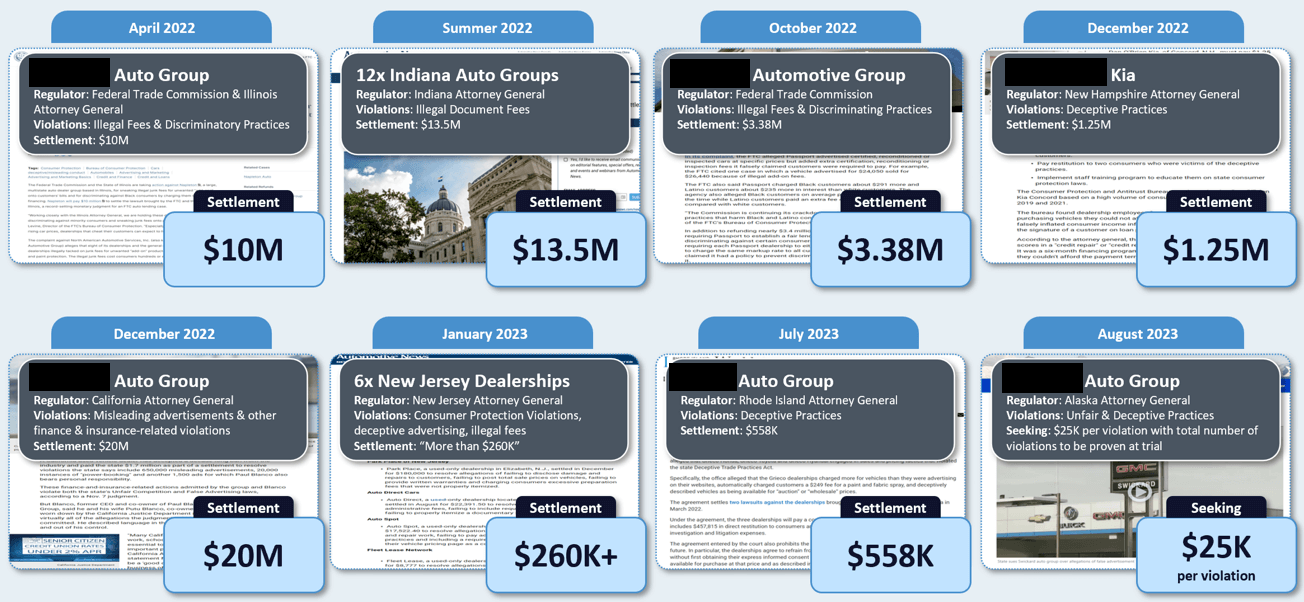

There are quite a few recent enforcement actions for legal advertising and fees that are already occurring in the auto industry.

This is not a new trend. This has been happening over the past couple of years. There have been allegations that each one of these dealership groups has essentially assessed fees that they were charging to consumers illegally. These enforcement actions are happening without the CARS Rule.

Regulators already have many weapons at their disposal.

One of the primary vehicles that the regulators can use is their ability to prosecute Unfair and Deceptive Acts and Practices.

- The FTC, under section five of the FTC Act, has the ability to prosecute unfair and separate acts and practices.

- The CFPB can do it under Dodd-Frank.

- The states under their Consumer Sales Practices Act and Deceptive Trade Practices Act. They also have the ability to prosecute unfair and separate acts and practices.

So those situations mentioned above would also be CARS Rule violations.

Using the Safeguards Rule as an Example

The Safeguards Rule was established in 2003. In the 2000s, we started to see a lot of data breaches occur. The FTC started taking enforcement actions against businesses in response to these breaches. These enforcement actions reflected omissions like not having multi-factor authentication in place, encryption, or continuous monitoring. Businesses got in trouble for not providing employee training. The FTC kept building these omissions into their enforcement actions, and into their orders, and faulting them.

Over time, the FTC revised the Safeguards Rule, establishing minimum standards. Now, for minimum standards, dealers are required to have multi-factor authentication, encryption, and continuous monitoring, along with many other things.

This parallels what we see progressing with the CARS Rule. The FTC is taking pains to outline the things that they consider already to be unfair and deceptive acts and practices.

Put Your Dealership on a Path to Compliance.

To avoid exposing your dealership to multimillion-dollar settlements, take the proper steps to achieve and maintain advertising sales and finance compliance.

KPA’s solution provides dealers with the tools they need to comply with the numerous federal and state laws and regulations that impact dealership advertising, sales, and finance practices, beyond the requirements within the CARS Rule.

It also provides consumers peace of mind, knowing that their dealership follows transparent best practices when selling or leasing their vehicles.

FTC CARS Resource Hub

Access our comprehensive resource hub for all the necessary information.